Navigating The Path To Homeownership: A Comprehensive Guide To Home Possible Maps

Navigating the Path to Homeownership: A Comprehensive Guide to Home Possible Maps

Related Articles: Navigating the Path to Homeownership: A Comprehensive Guide to Home Possible Maps

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Path to Homeownership: A Comprehensive Guide to Home Possible Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership: A Comprehensive Guide to Home Possible Maps

The dream of homeownership is a powerful motivator for many individuals and families. However, the path to achieving this dream can be complex and daunting. Navigating the intricate landscape of mortgage options, qualifying for a loan, and understanding the intricacies of the housing market can feel overwhelming. This is where Home Possible maps come into play, offering a valuable tool for prospective homebuyers to navigate the journey towards their own piece of the American dream.

Understanding Home Possible Maps: A Key to Accessibility

Home Possible maps are interactive online tools developed by Fannie Mae, a government-sponsored enterprise (GSE) that plays a crucial role in the secondary mortgage market. These maps serve as a valuable resource for homebuyers seeking affordable housing options within specific geographic areas.

How Home Possible Maps Work:

- Area Selection: Users begin by selecting a specific geographic region, such as a state, county, or city.

- Property Identification: The map displays available properties within the selected area that qualify for Home Possible financing. These properties are typically located in areas with lower median home prices, making them more attainable for first-time buyers and those with limited budgets.

- Filter Options: Users can refine their search by applying various filters, such as price range, number of bedrooms and bathrooms, and property type. This allows them to narrow down their options to properties that best suit their specific needs and preferences.

- Property Details: Clicking on an individual property reveals detailed information, including its address, price, square footage, and a brief description. This allows potential buyers to gain a comprehensive understanding of each property before making a decision.

- Loan Eligibility: Home Possible maps also provide information about loan eligibility criteria and potential down payment requirements. This transparency empowers users to understand the financial aspects of homeownership before embarking on the process.

Benefits of Utilizing Home Possible Maps:

- Accessibility: Home Possible maps remove the limitations often associated with traditional home searches, making homeownership more accessible to a broader range of individuals. By focusing on areas with lower median home prices, these maps open doors for those who may not have the financial resources to purchase homes in more expensive markets.

- Targeted Search: Home Possible maps eliminate the need for extensive manual searches, streamlining the process of finding suitable properties. Users can quickly identify properties that align with their budget and preferences, saving valuable time and effort.

- Transparency: The maps provide clear and concise information about each property, including its price, features, and loan eligibility criteria. This transparency empowers users to make informed decisions based on accurate and readily available data.

- Community Focus: Home Possible maps often highlight properties in communities with strong social infrastructure and amenities, providing potential buyers with valuable insights into the surrounding environment. This information is crucial for families seeking a supportive and thriving community for their future home.

- Financial Guidance: The maps provide information about loan eligibility criteria and potential down payment requirements, offering valuable financial guidance to prospective homebuyers. This transparency empowers users to understand the financial aspects of homeownership before embarking on the process.

Beyond the Map: A Comprehensive Approach to Homeownership

While Home Possible maps provide a valuable starting point for homebuyers, it’s important to remember that they are just one piece of the puzzle. Achieving homeownership requires a comprehensive approach that encompasses several key steps:

-

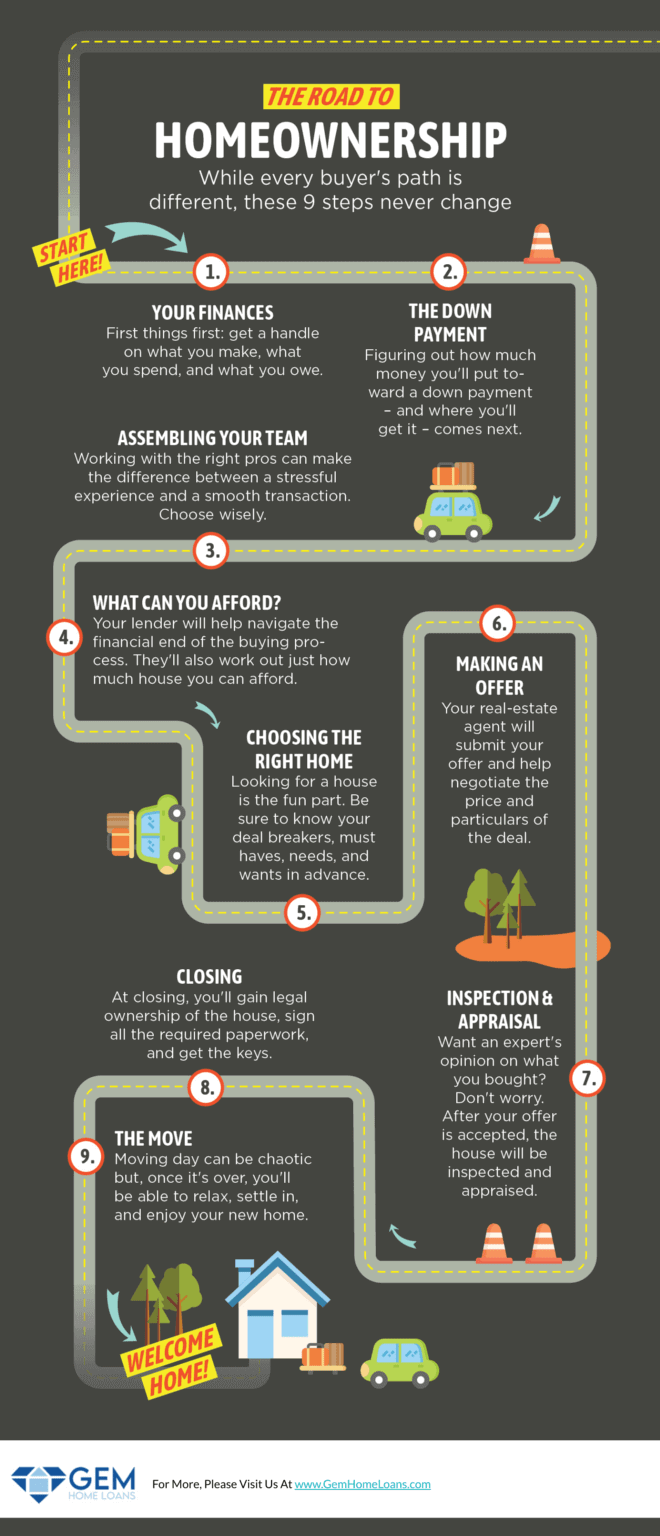

Financial Planning: Before embarking on a home search, it’s crucial to establish a solid financial foundation. This includes:

- Assessing your credit score: A strong credit score is essential for securing favorable mortgage terms.

- Creating a budget: Determine your monthly expenses and income to establish a realistic budget for your mortgage payments.

- Saving for a down payment: Aim to save a substantial down payment to reduce your monthly mortgage payments and avoid paying private mortgage insurance (PMI).

- Exploring loan options: Research different mortgage options, such as fixed-rate, adjustable-rate, and FHA loans, to determine the best fit for your financial situation.

-

Partnering with a Real Estate Professional: A knowledgeable real estate agent can provide invaluable guidance throughout the home buying process. They can:

- Help you find the right property: They can identify properties that meet your specific needs and preferences, often before they are listed publicly.

- Negotiate the best price: They can leverage their expertise to negotiate a favorable price for the property you choose.

- Guide you through the closing process: They can assist with all the necessary paperwork and legal procedures involved in closing the sale.

-

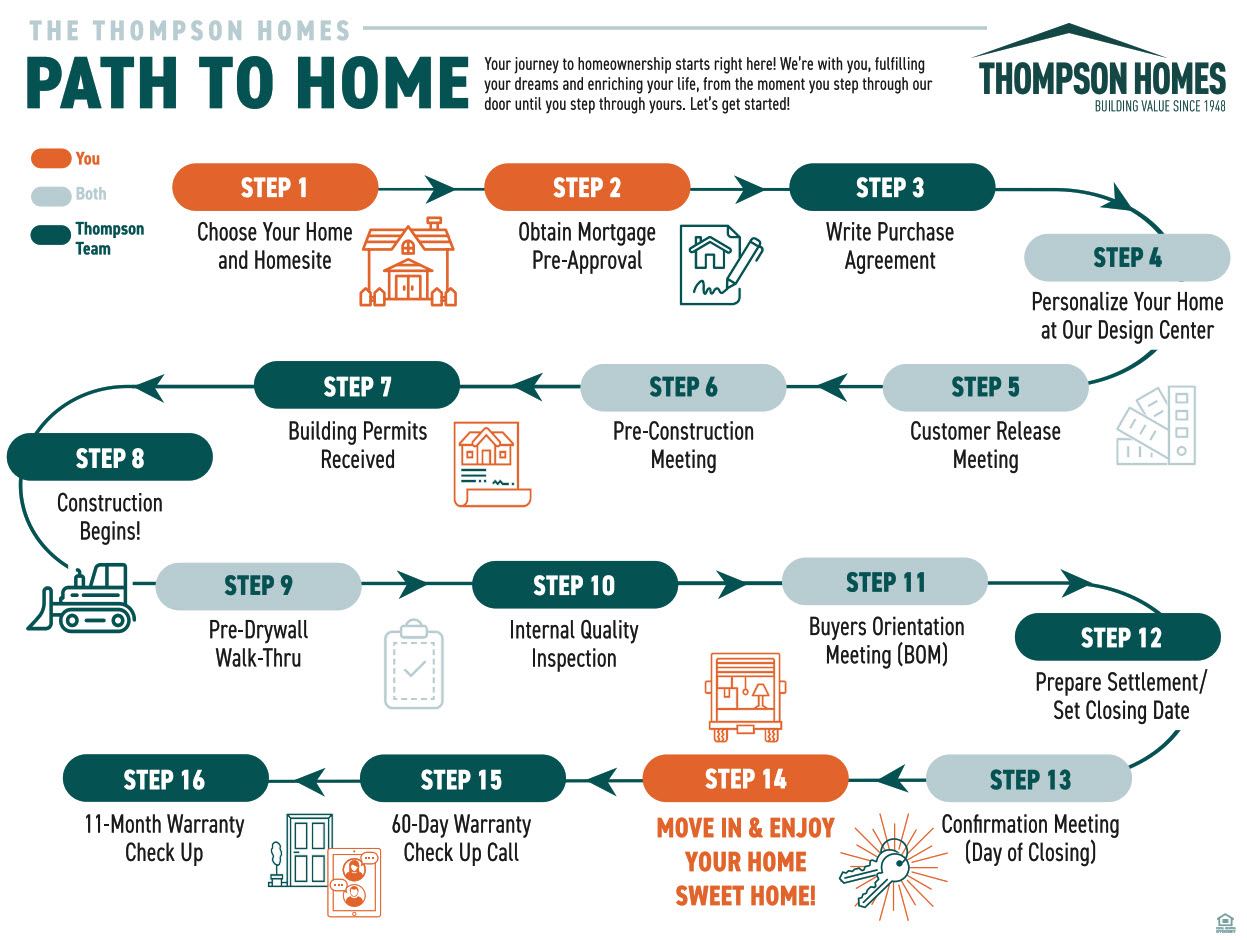

Understanding the Home Buying Process: The process of purchasing a home involves several steps, including:

- Getting pre-approved for a mortgage: This demonstrates your financial readiness to lenders and allows you to shop for properties with confidence.

- Making an offer: Once you find a property you like, you’ll need to submit a written offer to the seller.

- Negotiating the terms of the sale: This includes the purchase price, closing date, and any contingencies.

- Obtaining a home inspection: A professional home inspector will assess the property’s condition and identify any potential problems.

- Closing the sale: This involves signing all the necessary documents and transferring ownership of the property to you.

FAQs: Addressing Common Concerns

Q: What is the minimum down payment required for a Home Possible loan?

A: The minimum down payment for a Home Possible loan is 3% of the purchase price. However, buyers may be eligible for down payment assistance programs that can reduce the required down payment even further.

Q: Are there income limits for Home Possible loans?

A: There are income limits for Home Possible loans, which vary depending on the location of the property. The maps provide information about these income limits for each geographic area.

Q: Who is eligible for a Home Possible loan?

A: Home Possible loans are available to first-time homebuyers, as well as those who have not owned a home in the past three years. The loans are also available to borrowers who meet specific income and credit score requirements.

Q: Are there any restrictions on the type of property that qualifies for a Home Possible loan?

A: Home Possible loans are available for single-family homes, townhouses, and condominiums. There are some restrictions on the size and age of the property, but these vary depending on the location.

Q: How can I find a lender who offers Home Possible loans?

A: You can find a lender who offers Home Possible loans by visiting the Fannie Mae website or contacting a local mortgage broker.

Tips for Utilizing Home Possible Maps Effectively:

- Be realistic about your budget: Before you start searching for homes, it’s important to have a clear understanding of your financial capabilities. Determine your monthly budget for mortgage payments and consider factors such as property taxes, insurance, and maintenance costs.

- Focus on your needs and preferences: When browsing through available properties, consider your specific needs and preferences. Do you prioritize a large backyard, a short commute to work, or proximity to schools?

- Don’t hesitate to reach out for assistance: If you have any questions or need help navigating the map, don’t hesitate to contact a real estate professional or a mortgage lender. They can provide valuable insights and guidance throughout the process.

- Explore the surrounding community: Once you’ve identified a property you’re interested in, take some time to explore the surrounding community. Visit local businesses, schools, and parks to get a feel for the neighborhood.

- Be patient and persistent: The home buying process can be time-consuming, so it’s important to be patient and persistent. Don’t be discouraged if you don’t find the perfect property right away.

Conclusion: Empowering Homebuyers with Accessible Solutions

Home Possible maps represent a significant step towards making homeownership more accessible to a broader range of individuals. By providing a targeted and user-friendly platform for searching for affordable properties, these maps empower potential buyers to navigate the complex world of real estate with confidence.

While the maps offer valuable insights and resources, it’s crucial to remember that they are just one component of the overall home buying journey. By combining the power of Home Possible maps with thorough financial planning, expert real estate guidance, and a comprehensive understanding of the home buying process, individuals can pave the way towards achieving their dream of homeownership.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership: A Comprehensive Guide to Home Possible Maps. We appreciate your attention to our article. See you in our next article!